Introduction to DeFi

Imagine you want to provide a very simple financial service on the Internet. Two people, Alice and Bob, want to lend money to a third person, Eve. Eve provides some collateral in exchange for the loan. After a set period of time, Eve will return the money plus an interest payment to Alice and Bob.

Eve, Bob, and Alice are unfortunately all jaded individuals – scarred by previous betrayals in life. They don’t trust anyone, not a lawyer, not a bank, not even each other, to hold the money nor the collateral. So they write a small computer program to hold the assets and execute the logic of the loan. This program, this “Smart Contract”, is a basic financial application. And because this jaded group of financial pioneers don’t want to trust a single computer (nor the computer’s owner) with the execution of the financial app, they run the smart contract on a blockchain where a global network of computers ensure the program’s proper execution. Now our financial application has been decentralized. This, then, is a basic decentralized financial application. Welcome to DeFi.

Smart Contracts Limitations with Bitcoin

Blockchains like Ethereum and others were built with smart contracts in mind. Each node on the Ethereum network runs the Ethereum Virtual Machine (EVM) that can execute the logic of smart contracts. Unfortunately, Bitcoin was not designed with smart contracts in mind. It is designed as a decentralized system to keep track of who owns how many Bitcoins. That’s it. There is no room for sophisticated DeFi logic.

Also, each of these blockchain networks usually have their own native coin (for Ethereum it’s ETH) the value of which fluctuates in relation to Bitcoin. This creates a problem if you want to get involved in DeFi, but don’t want to expose yourself to the fluctuations in value of other currencies. (This is even worse if you believe that all currencies except Bitcoin are worthless.)

Rootstock and rBTC

Money on Chain (MoC) is a DeFi application for the Bitcoin enthusiast. I’m going to describe how Money on Chain works, but first it’s useful to know how folks enabled Bitcoin holders to take advantage of smart contracts.

The solution is actually quite simple. The folks at Rootstock (RSK) have setup a blockchain similar to Ethereum where in the onramp to that blockchain users exchange their Bitcoin (BTC) in a 1-to-1 ratio for their blockchain’s native coin rBTC (just BTC with a little “r” in front of it. Cute!). Nodes on the Roostock blockchain are able to interpret smart contracts because they run a virtual machine based on the Ethereum Virtual Machine (EVM) called the RSK Virtual Machine (RVM). Once BTC holders convert their BTC to rBTC they can take advantage of DeFi applications build on Rootstock. One of these DeFi applications is Money On Chain.

The Money On Chain DeFi Platform

The Money on Chain Protocol (MOC Protocol) is made up of several components. To simplify and clarify the explanation, I will introduce some new imaginary characters. Each character will take advantage of a certain aspect of the DeFi platform. Each of the characters holds Bitcoin and believes deeply in the value of Bitcoin. However, each character has different characteristics and motivations.

Part 1: Dave (Dollar on Chain)

Dave is late in his career and approaching retirement. Much of his retirement wealth is in Bitcoin and he is therefore wary of Bitcoin’s price volatility. After all, it would put him in a very difficult spot should Bitcoin’s price in dollar value drop drastically.

The MOC Protocol has a token called Dollar on Chain (DoC). DoC acts as a stablecoin meaning that it is meant to remain stable in value. By interacting with the Money on Chain smart contract, Dave can exchange his rBTC for DoC tokens at the current BTC to USD rate. So, for example, if 1 Bitcoin = $60,000, Dave can exchange 1 rBTC for 60,000 DoC and the smart contract is designed such that 1 DoC will always equal $1 USD. In other words, DoC maintains a 1:1 peg to the US Dollar.

By doing so, Dave is now shielded from any fluctuations in the value of Bitcoin. Let’s imagine Bitcoin’s price drops by 50% against the dollar. Dave would still have 60,000 DoC so his position is basically unchanged. Of course should Bitcoin’s value go up by 20% he won’t share in that gain, but he can sleep easy at night knowing the value of his assets will not change.

| Name | Position if Bitcoin +20% | Position if Bitcoin -50% | Notes |

| Dave (DoC) | 60,000 DoC | 60,000 DoC | No change in value. |

Part 2: Ginny the Gemini (BTCx)

Ginny’s Zodiac sign is the Twins of Gemini. Like her sign, she is quirky, fun, and adventurous. Ginny is early in her career and holds some Bitcoin. True to her adventurous nature, risk is much more acceptable to her than Dave as long as there is a chance for a bigger payoff.

The MOC Protocol has a token called BTCx for users like Ginny. When Ginny exchanges her rBTC for BTCx the MOC Protocol promises them a leveraged return on their rBTC up to 2x (Geminis like anything 2x). Ginny will have to agree to a small interest payment for this position but this doesn’t bother her. As a result if, for example, the value of Bitcoin goes up by 20%, Ginny could cash out her BTCx for rBTC and receive roughly 40% more rBTC return on her investment.

Where does the smart contract get the additional rBTC to pay Ginny? In part from the rBTC contributed by Dave for his DoC. Of course, should the value of Bitcoin go down by 50%, because of Ginny’s 2x leveraged position, she would experience 2x the loss. This means she would lose 100% of her value and she is effectively “liquidated.”

| Name | Position if Bitcoin +20% | Position if Bitcoin -50% | Notes |

| Dave (DoC) | 60,000 DoC | 60,000 DoC | Pegged 1:1 USD |

| Ginny (BTCx) | +40% | -100% liquidated | Also has interest payments to make. |

At this point it’s worth noting that I’m a lawyer and a computer programmer, so I have to admit that financial modeling is not my strong suit. So please take my explanation of the financial model of the Money on Chain Protocol with a grain of salt. That said, with just Dave and Ginny, the MOC Protocol would face pretty high constraints regarding how much the value of Bitcoin could fluctuate before the financial model for the smart contract starts to break down.

For example, once all of the Ginnys are liquidated, should Bitcoin continue to decline in value there may not be enough rBTC liquidity to payout Dave’s DoC tokens. Similarly, should Bitcoin increase in value too much there may not be enough to pay Ginny’s 2x position. To address this and provide additional liquidity to the system there is a third token.

Part 3: Betty (BPro)

Dave and Ginny represent two extremes of MOC Protocol participants. Dave has zero risk and Ginny has all the risk (and potential reward). However, it would be useful for the MOC Protocol to have a mechanism for even more rBTC liquidity and mitigate some of the risk. This is where the BPro token comes in.

Betty is a business woman. She too believes in the value of Bitcoin. She plans to hold Bitcoin for the long term and would like to position her Bitcoin holding in such a way that she could get a return on her investment beyond the value change of Bitcoin itself. The BPro token within the MOC Protocol is a good fit for her. When Betty exchanges her rBTC for BPro she will get the benefits of the interest payments that were charged to Ginny for her BTCx. Betty’s BPro also has a small variable leveraged position (not nearly as risky as Ginny’s 2x position). Historically, BPro holders have received +30% return on their holding on top of any value change of Bitcoin itself.

Continuing the hypotheticals we used with Ginny and Dave, should the value of Bitcoin-USD exchange go up by 20%, Betty might see a gain of, say, 22% value of her BPro. Additionally, she receives the interest payments made by Ginny. So her total return on investment would be even greater. If Bitcoin’s value decreases by 50%, because Betty is slightly leveraged she may experience, say, a -56% change in value, but that loss in value will be mitigated by the interest payment she receives.

| Name | Position if Bitcoin +20% | Position if Bitcoin -50% | Notes |

| Dave (DoC) | 60,000 DoC | 60,000 DoC | Pegged 1:1 USD |

| Betty (BPro) | +22% + Interest | -56% + Interest | Benefits from Ginny’s interest payments. |

| Ginny (BTCx) | +40% | -100% liquidated | Also has interest payments to make. |

The idea here is that BPro holders can provide a lot of the liquidity needed for the MOC Protocol. The incentive for doing so is that they receive a modest and consistent increase in value of their holdings.

If you’d like to see a video animation explaining how the interplay between DoC, BPro, and BTCx in the context of different hypothetical scenarios, I recommend this video provided by the Money on Chain folks.

Fees on the MOC Protocol

It’s important to note that in order to use the MOC Protocol, all participants will have to pay some minimal fees for exchanging rBTC for DoC, BTCx, and BPro and vice versa. These exchanges happen on the MOC Protocol token exchange platform (called “TEX”). Some of these fees go to node operators. Some of the value collected from fees are also distributed to BPro holders as an additional incentive to hold the BPro token.

MOC Protocol Governance

One important aspect of any decentralized platform is how to update the functionality of the platform once deployed. All of the Daves, Bettys, and Ginnys may be enjoying this DeFi platform as the original smart contract was written, but it’s possible in the future that the financial model may need to be updated or additional financial services would need to be added. This becomes a question of governance of the protocol itself. Who has the power to make decisions regarding future changes?

For this, the MOC Protocol has one final token, the MoC token (for the sake of this article “MOC Protocol” refers to the overall DeFi application platform while “MoC” will refer to the governance token). Holders of MoC token get to vote on changes to the platform in proportion to their MoC token holdings. At regular intervals MoC tokens are distributed to node operators as a reward for providing computing power to the network. MoC tokens are also distributed to BPro token holders as an additional incentive for them to provide liquidity to the network. Finally, MoC tokens are provided to MoC token holders. (Yes, that sounds somewhat recursive, but indeed MoC token holders are rewarded with more MoC tokens.)

Conclusion

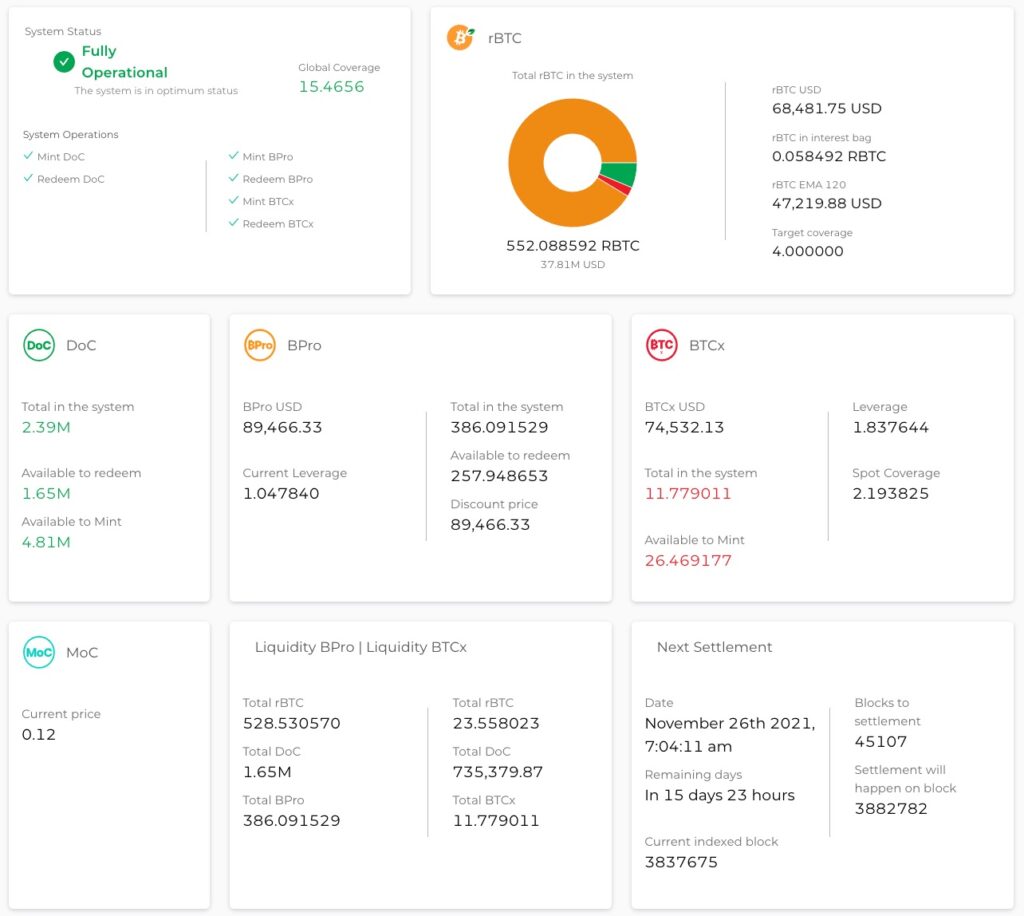

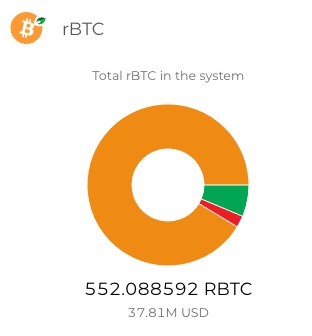

Hopefully, you now have a high-level understanding of how the MOC Protocol operates to provide Bitcoin holders some decentralized financial services. While the different tokens of DoC, BTCx, and BPro were given roughly equal treatment in this article, in reality the BPro holders are main customers and liquidity providers in the system. Here is a pie chart representing all of the rBTC in the system contributed by the different types of participants: DoC (Green), BTCx (Red), and BPro (Orange).

The smart contracts are responsible for automatically maintaining the appropriate ratio of participants and adjusting interest rates and leverage positions appropriately to ensure the proper liquidity in the system in response to market changes in Bitcoin value. According to the the folks at Money on Chain, currently there is around $74,000,000 USD in total value locked on the platform.

You can see a dashboard of the current state of the system at https://alpha.moneyonchain.com/metrics. This is difficult to reach in some jurisdictions where participation in the dApp is not allowed, but I’ll include a screenshot below as an example.